Pre tax 401k calculator

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Select a state to.

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

When you make a pre-tax contribution to your.

. About Your Savings Enter what you have currently saved how much you could put in a monthly contribution to a 401 k and how much your employerthe. Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction. The annual maximum for 2022 is 20500.

NerdWallets 401 k retirement calculator estimates what. Reviews Trusted by Over 45000000. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

For instance a person who makes 50000 a year would put away anywhere. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Contributing to a 401 k is one of the best ways to prepare for retirement. The Roth 401 k allows you to contribute to your 401 k account on an after. For some investors this could prove to be a better option than the Traditional 401 k contributions where deposits are made on a pre-tax basis but are subject to taxes when the.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Ad Discover Our Retirement Calculator Financial Tools To Help You Create A Plan. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

Traditional 401 k Calculator. For example if you earn 10000 per month and contribute 10 of it towards a 401k retirement savings account. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn.

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. For example if your household taxable income is 500000 youre in the 35 marginal tax bracket¹ If you retire in 2022 and have taxable income of 340000 from pre-tax. Roth 401 k vs.

Retirement Calculators and tools. Forbes Advisors 401 k calculator can help you understand how much you can save factoring in your. If you are age 50 or over.

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Choose the appropriate calculator below to compare saving in a 401 k account vs. Compare 2022s Best Gold IRAs from Top Providers.

Current Age Retirement Age Step 2. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. State Date State Federal.

This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years. By making pre-tax contributions you are lowering your current taxable income. A 401 k contribution can be an effective retirement tool.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. TIAA Sixty Second Solution To Estimate How Much You Need To Save For A Goal. 401k Calculator A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

After Tax Contributions 2021 Blakely Walters

How To Calculate Bond Risk Our Deer Safe Investments Bond Investing Money

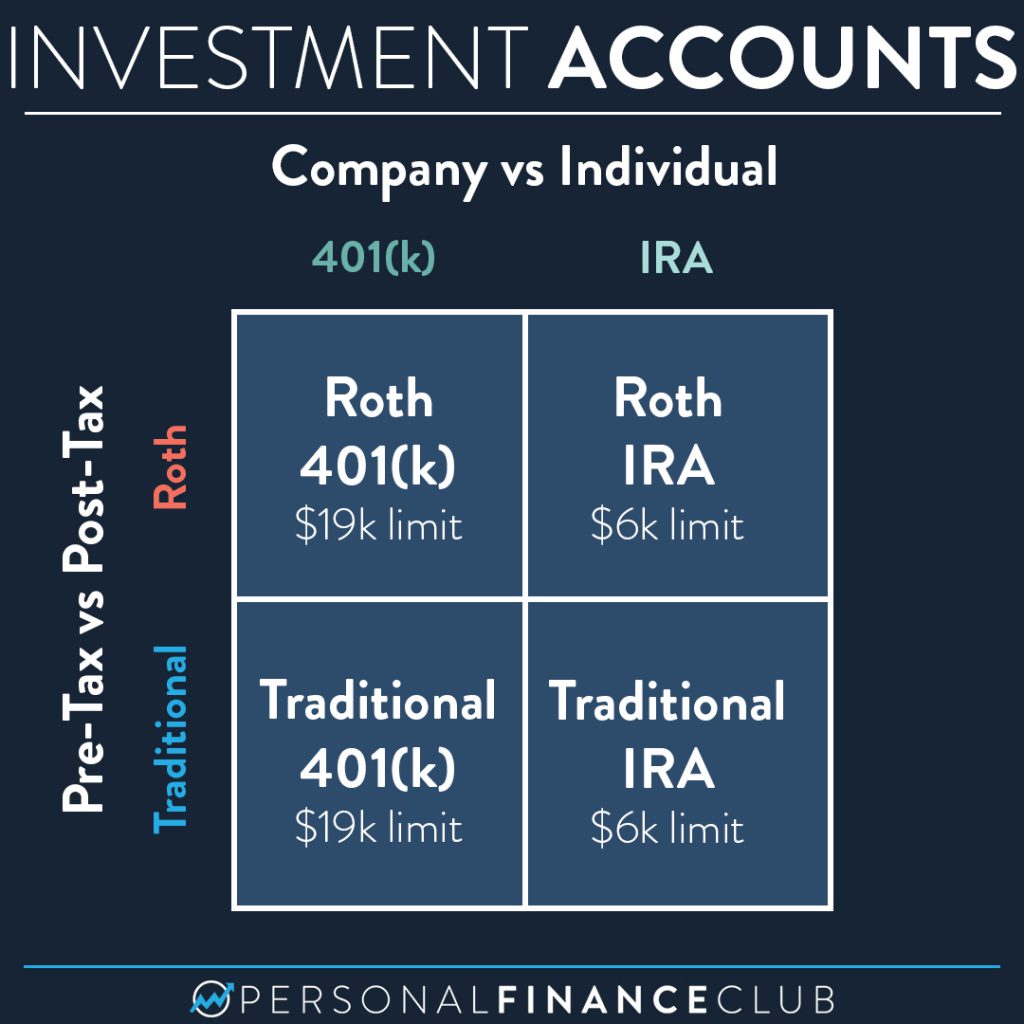

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

After Tax 401 K Contributions Retirement Benefits Fidelity

How A Diversified 401 K Strategy Can Cut Your Taxes Fisher Investments 401 K Solutions

High Earners To Roth 401 K Or Not Greenleaf Trust

Roth 401k Roth Vs Traditional 401k Fidelity

Mortgage Calculator Mortgage Calculator From Bankrate Com Calculate Payments Wit Mortgage Loan Calculator Mortgage Calculator Mortgage Amortization Calculator

The Ultimate Roth 401 K Guide District Capital Management

Solo 401k Contribution Limits And Types

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Complete Retirement Guide To 401 K For Beginners Retirement Savings Plan Investing For Retirement Preparing For Retirement

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

How Much Should I Put Into My 401k Plan Simple Life And Money How To Plan 401k Plan Retirement Calculator

2019 Solo 401k Contributions Plus Voluntary After Tax My Solo 401k Financial

After Tax 401 K Contributions Retirement Benefits Fidelity